StandardAero (SARO)·FY 2025 Earnings Summary

StandardAero Posts Strong First Full Year as Public Company: Revenue Up 16%, FCF Swings to $205M

January 27, 2026 · by Fintool AI Agent

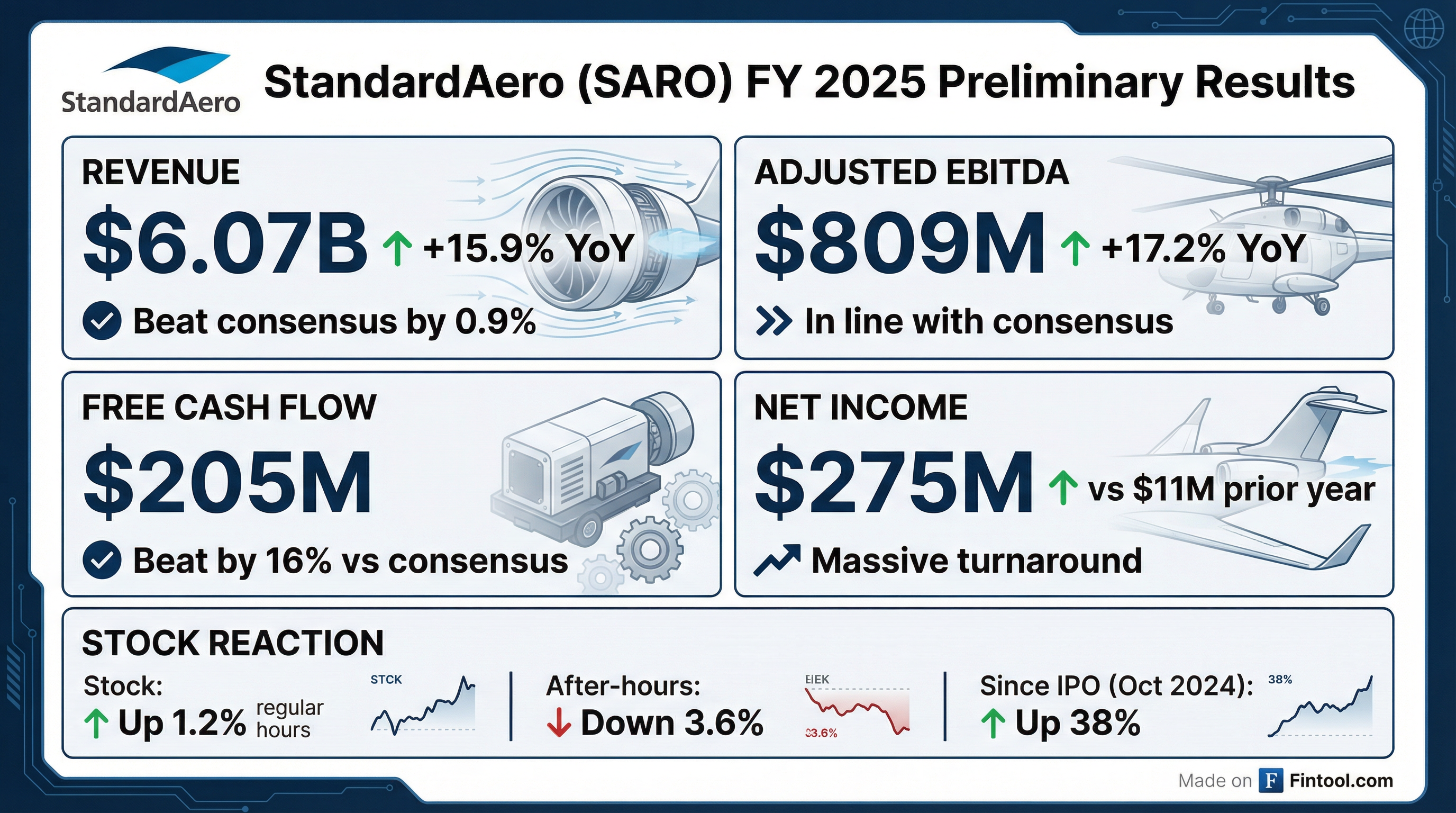

StandardAero (NYSE: SARO) released unaudited preliminary results for its first full fiscal year as a public company, delivering revenue of ~$6.07B (+15.9% YoY) that beat consensus by 0.9% and Adjusted EBITDA of ~$809M (+17.2% YoY) that met expectations. The most notable development was the dramatic free cash flow turnaround—from negative $45M in FY 2024 to positive $205M in FY 2025—reflecting supply chain improvements and working capital normalization that management had signaled throughout the year. Shares fell 3.6% in after-hours trading to $31.92, despite the in-line results.

Did StandardAero Beat Earnings?

StandardAero delivered modest beats across its key metrics for FY 2025:

*Values retrieved from S&P Global.

The company provided ranges for preliminary results: Revenue $6,053-6,083M, Adjusted EBITDA $806-812M, Net Income $270-280M, and Free Cash Flow $200-210M.

The massive net income improvement—from $11M in FY 2024 to $275M—reflects significantly reduced interest expense following the IPO-driven debt paydown and the absence of IPO-related costs.

How Did the Stock React?

The stock reaction was muted despite the beats:

The after-hours decline suggests investors may have been hoping for a stronger beat or 2026 guidance, which management indicated will be provided when final Q4/FY 2025 results are released next month.

What Changed From Last Quarter?

Several dynamics shifted from Q3 2025:

1. Supply Chain Unwind Delivered — Management's Q3 promise of a strong Q4 cash flow surge materialized. Contract assets, which had ballooned $300M over the prior 12 months due to constrained forgings and castings, unwound as expected. The full-year FCF of $200-210M exceeded the raised guidance of $170-190M from Q3.

2. EBITDA Margin Maintained — Adjusted EBITDA margin came in at 13.3% (midpoint), a 10 basis point improvement from FY 2024's 13.2%, despite dilution from the LEAP and CFM56 DFW facility ramps.

3. Buyback Authorized — In December 2025, the board authorized a $450M share repurchase program, signaling confidence in cash generation and valuation.

What's the Full-Year Story?

FY 2025 marked StandardAero's first full year as a public company following its October 2024 IPO at $24/share—the third-largest U.S. IPO of 2024. The company significantly exceeded its pre-IPO targets:

The key drivers of the revenue growth were:

- LEAP Engine Program: Nearly 50 engines inducted through Q3, with full-year inductions exceeding 60. Revenue nearly doubled sequentially in Q3.

- Business Aviation: HTF 7000 program growth driven by Augusta facility expansion

- Military Strength: V-22 recovery, C-130 programs, and T-38 J-85 engine volumes

What's Coming in 2026?

Management highlighted several structural improvements for 2026 during the Q3 call:

1. LEAP/CFM56 Turn Profitable — Both the LEAP industrialization and CFM56 DFW expansion, which ran at 0% margins in 2025, are expected to turn margin-positive in early 2026 and become accretive at the company level by 2027.

2. Material Pass-Through Elimination — $300-400M of zero/low-margin material pass-through revenue will be eliminated through contract renegotiations. This will nominally reduce reported revenue but improve margins and cash flow.

3. LEAP Backlog Growing — LEAP backlog stood at over $1B (+5% QoQ in Q3), with management reiterating the target of $1B in annual LEAP revenue by late 2029/2030.

Key Quotes From Management

From the Q3 2025 earnings call:

"This call marks an important milestone for us as we recently completed our first full year as a publicly traded company. We continue to be pleased with the performance of the business, which is well ahead of the targets we set in advance of the IPO." — Russell Ford, Chairman & CEO

"We have now made meaningful progress renegotiating several contracts that achieved structural changes to reduce or eliminate this pass-through activity, and we expect to see a clear positive impact in 2026." — Dan Satterfield, CFO

"StandardAero will continue to deliver as promised." — Russell Ford, Chairman & CEO

Risks and Concerns

1. Preliminary Results Subject to Revision — These are unaudited estimates; final results could differ materially as year-end close procedures complete.

2. 2026 Guidance Not Yet Provided — Investors lack visibility into next year expectations until the full Q4/FY 2025 report.

3. Carlyle Overhang — The Carlyle Group remains the majority shareholder post-IPO. Secondary offerings in progress (S-3ASR filed January 27, 2026) could create selling pressure.

4. Supply Chain Risks Persist — While improving, constrained forgings and castings remain industry-wide issues that could re-emerge.

Forward Catalysts

The Bottom Line

StandardAero delivered a solid first full year as a public company, with revenue and EBITDA growth exceeding initial guidance and a remarkable free cash flow turnaround. The in-line results and muted stock reaction suggest the strong performance was largely priced in after the stock's 38% run since IPO. The real test comes next month when management provides 2026 guidance and investors can assess whether the margin expansion from LEAP/CFM56 profitability and pass-through elimination will accelerate earnings growth.

For more on StandardAero, see the company page or read the Q3 2025 earnings transcript.